Article II 2/2025 - TEMPERATE SEAWEED MARKETS: AN OVERVIEW

A look back

a. Market demand continues to rise

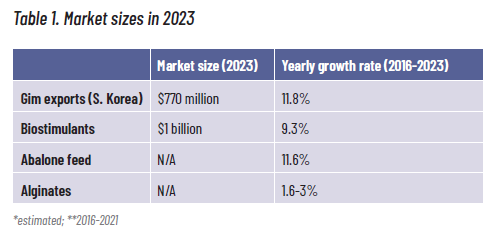

Three temperate seaweed markets have seen strong growth in recent years: South Korean gim (nori in Japanese; laver in English), biostimulants and abalone feed (Table 1). The alginates market grew as well, but at a lower pace.

In 2016, the value of gim exports from the Republic of Korea stood at USD 353 million. In 2023, these exports had risen to USD 771 million, representing an average 11.8% year-on-year growth in the seven-year period. The largest markets in 2023 were the United States at USD 169 million, China at USD 144 million, Japan at USD 97 million, Thailand at USD 66 million and the Russian Federation at USD 57 million.

Biostimulants

The global seaweed extracts biostimulant market was estimated at USD 535 million for 2016. According to The Nature Conservancy and Bain, the seaweed biostimulants market was worth around USD 1 billion in 2023, implying a yearly growth rate of 9.3% in the past seven years. While tropical seaweeds have taken a share of this market in recent years, the vast majority of products sold remain based on temperate seaweeds.

Abalone feed

Farmed abalone production grew from 156 875 tonnes in 2016–2017 to 243 506 tonnes in 2020–2021. Abalone are generally fed a mixture of temperate-water seaweeds, some of which is grown on farms at nearby locations, while the rest is sourced from wild stands or algal blooms. As such, abalone aquaculture has boosted seaweed production. However, due to the self-contained nature of the trade, with many farms cultivating both abalone and the seaweeds to feed them, an estimate on market value is not available.

Alginates

In 2016, global alginate production totaled 48 144 tonnes according to Porse & Rudolph. In 2023, insiders estimate global alginate production at 55 000 tonnes, implying a compound annual growth rate of 1.6%. This is lower than the estimate of hydrocolloids research firm IMR, which puts the growth rate at 2.5–3%. Sausage casings have been a strong growth market in recent years. Due to improved processing technology, alginate sausage casings now offer considerable cost and efficiency savings compared to incumbent hog, sheep, collagen or cellulose casings. The growth of plant-based and halal markets are additional drivers of demand.

The market for alginate-based acid reflux medicine is also growing. Previously confined to Europe, pioneering remedy Gaviscon has seen increased uptake in the United States. Competitors have sprung up and found success too. The market for alginate-based dental moulds is likely in decline due to the advent of digital imaging. For the size and growth trajectory of other alginate markets like textile printing paste, wound dressings and various food applications, no reliable numbers were found.

Food

Trends in food markets for temperate seaweeds vary by country. Japanese seaweed consumption has nearly halved in 20 years, from 4.0 grams per person per day in 2002 to 2.1 grams per person per day in 2022, an annual decline of 3.2%. This is in line with the trend in Japanese fish and shellfish consumption, which also saw a decline close to 50% this century, from 40.2 kilograms per capita in 2001 to 22 kilograms in 2023. High prices, a desire for convenience and a diversification of the Japanese diet towards more meat and foreign cuisines are the main reasons cited for the long-term decline.

In Korea, daily seaweed consumption remained stable: in 2014, 3.3 g of seaweeds were consumed per person per day. In 2022, this had risen slightly to 3.4 g per person per day. In China, increasing urbanisation and consumers’ growing nutritional knowledge drove growth in seaweed consumption in the first decade of the century, when total seaweed consumption increased from approximately 2 g per person per day in 2004 to 3.1 g per person per day in 2009. No reliable data was found for the evolution in the past 15 years.

In Europe and North America, the consumption of algae remains limited but is experiencing a growing trend due to increases in product availability and positive media attention. However, a lack of data regarding availability and consumption prevents accurate statements about market size and growth trends.

One notable feature of Western seaweed food markets is the contrast between high demand and insufficient supply of dulse (Palmaria palmata), and low demand and oversupply for sugar kelp (Saccharina latissima). The increasing demand for dulse, primarily from food manufacturers, exceeds the current production based primarily on wild-harvested biomass, leading to high prices. According to Stévant et al., the wholesale value of dried dulse was 16–19 €/kg ten years ago, now 40–75 € per kg (USD 20–37 per pound). To compare, cultivated kelps sell wholesale for 2–4 €/kg. The current median retail price of dried dulse is 134€ per kilogram (USD 66 per pound).

Cosmetics and personal care

Seaweed extracts for use in cosmetics and personal care products could be a source of significant value. However, extracts tend to be sourced from small, specialised firms before formulation by bigger brands, which makes it difficult to gauge market size. Indicators of market growth are not consistently pointing in the same direction: Setalg, a subsidiary of agribusiness conglomerate Groupe Roullier specialising in seaweedbased cosmetics, closed its doors in 2024 due to a lack of profitability. In the same year, Australia’s Marinova, a provider of fucoidans mostly for personal care brands, expanded its production capacity.

Emerging markets

Emerging markets, including nutraceuticals, biomaterials, feed and pet food supplements, methane-reducing feed additives, specialty chemicals and bioremediation are still nascent and for now too small to estimate.

b. Declining supply trend and price hikes in Asia

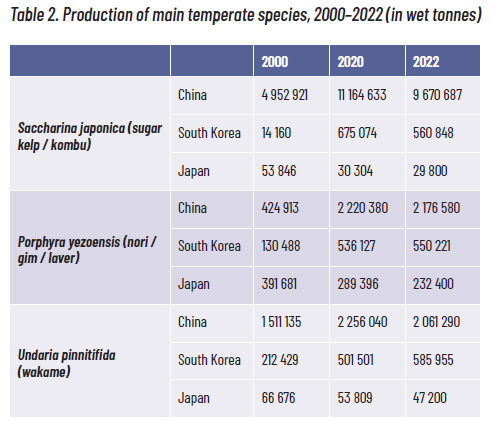

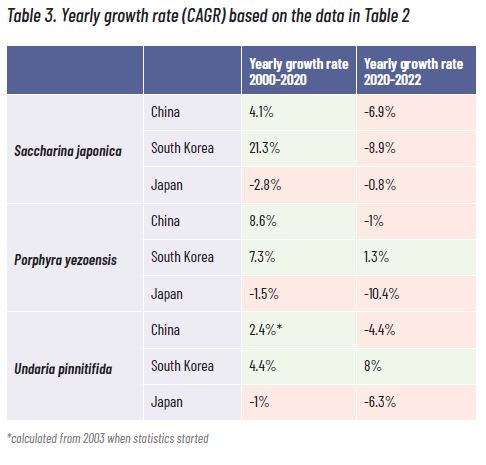

The harvests of three main temperate seaweed species in top producing countries in wet tonnes (according to FAO numbers), and their yearly growth rates are shown in Table 2 and Table 3.

According to FAO data, cultivation of Saccharina japonica in China grew at a yearly rate of 4.1 percent between 2000 and 2020, from 4.9 million tonnes to 11.2 million tonnes wet weight.

While the exact size of China’s production is sometimes called into question, the fact that the industry underwent strong growth is undeniable. However, recent events indicate that this rapid expansion has now hit a bottleneck.

According to Hu et al., in 2022, around 440 000 tonnes (dry weight) of S. japonica in Shandong bleached and decayed owing to environmental fluctuations, most likely due to a breeding-induced, biased allocation of energy resources. Kelp breeding systems in China have encountered problems relating to germplasm diversity, regulation and technological innovation. In combination with the pressures of warming waters and ocean acidification, this has led to production decline.

In South Korea, harvest numbers exhibit a similar pattern. Cultivation of S. japonica expanded massively for two decades, but declined after 2020. In Japan, the decline started earlier and has been more gradual. The price of kombu reached a high of 1 620 yen (USD 11.4) per kilogram in Japan in 2024 after another bad harvest blamed on rising ocean temperatures.

In Europe and North America, the cultivation of Saccharina latissima was initiated around 15 years ago. While kelp farming is now established with dozens of small-scale farms operating across North America and northwestern Europe, volumes have remained limited, with a lack of demand seen as the major impediment to greater production volumes. In the United States, around 600 tonnes of seaweeds were harvested in Maine in 2024. In Alaska, harvests decreased from nearly 400 tonnes in 2022 to somewhere around 100 tonnes in 2024. Norway harvested 600 tonnes in 2023. Leading companies in France and the Faroe Islands harvested 200 and 240 tonnes of seaweeds respectively in 2023. In each location, the majority of seaweeds were S. latissima.

To sum up: in Asia, the cultivation of Saccharina spp. is in decline due to pollution, climate change and past kelp breeding strategies coupled with a lack of timely innovation. The production shortfall is leading to price spikes. In the meantime, the opposite is true in Europe and North America: production is at overcapacity, but expansion is hampered by a lack of processing infrastructure and product-market fit.

Pyropia yezoensis (nori) and Undaria pinnitifida (wakame)

While production numbers for P. yezoensis show a similar pattern to those for S. japonica for the first two decades of the new millennium, the picture is less marked beyond 2020. In sum, the production of P. yezoensis by the three biggest producers has seen a slow decline of 1.4 percent annually from 2020 to 2022, from 3 045 903 tonnes to 2 959 201 tonnes. In combination with the strong increase in demand from international markets, this has led to dramatic price spikes. Harvest numbers for U. pinnitifida exhibit the same trend as P. yezoensis: after 2020, growth turned to decline for China, decline accelerated in Japan, while South Korea managed to continue to expand production. Although the total decline is less pronounced compared to P. yezoensis and S. japonica, here too Japanese consumers have been hit by price hikes, with the average price of boiled wakame reaching 2 479 yen (USD 16) per kilogram in 2024, up 54% from last year.

A look forward

The two key challenges for the Republic of Korea are labour and seed stock. Large labour shortages exist in rural areas and are set to rise with the average age of the farmer at 66 years old. However, only 19% of Koreans support an increase in immigration. With this in mind, seaweed producers have strong incentives to increase investments in mechanisation to address growing labour shortages.

When it comes to seed stock, the government’s Golden Seed Program is bearing fruit. More cultivars are being registered in an effort to balance resilience, productivity and taste. The focus is on Pyropia spp. where the amount of registered cultivars went from only one in 2014 to 13 in 2019.

In conclusion, while demand for Korean gim is set to continue to rise, recent price movements indicate that the work on cultivars and automation is not moving quick enough to offset the negative effects of climate change and labour shortages in the near term. This leads us to conclude that prices will continue to rise in the near future which in turn is likely to spur innovation and a search for new geographies.

Biostimulants

According to The Nature Conservancy and Bain, the seaweed biostimulants market is expected to grow at 13% per year. Starting from USD1 billion in 2023, that would make it roughly a USD 2.5 billion market in 2030, covering about 1% of all global farmland. Dunham-Trimmer estimates the total biostimulant market was worth USD 3 billion in 2023 and projects it to double by 2030, implying a 10.4% growth rate. With the market share for seaweed extracts stable at around 30%, that would make it a USD 1.8 billion market, which is in line with The World Bank’s estimate of USD 1.87 billion by 2030.

Agrochemical giants are more bullish in their projections for their biologicals divisions, with Bayer and Corteva projecting 17% until 2035 and FMC even 20% until 2033.

High-G alginates

In 2010, a review of the hydrocolloid industry concluded: “Within the last 10 years, a marked shift has taken place in the seaweed species being used to extract alginates. In 1999, Ascophyllum and Macrocystis accounted for 58% of the wild harvest, but today Laminaria and Lessonia are dominant, accounting for 81% of the harvest. This reflects a shift in market demand. Today’s most important and profitable applications require the high-G extracts from Laminaria and Lessonia, not the low-G extracts from Ascophyllum and Macrocystis.”

In 2022, according to FAO numbers, that picture largely remained the same, with 84% of alginate-bearing wild harvested seaweeds coming from Lessoniaceae (314 000 tonnes) and Laminariaceae (180 000 tonnes). Ascophyllum nodosum harvests have rebounded from a low of 56 000 tonnes in 2015 to 78 000 tonnes in 2022, however, the majority of this harvest now goes to biostimulants.

Advances in scientific research of applications for alginates in food and medical fields suggests the demand for wild harvested Lessonia spp. and Laminaria spp. will continue to grow as they are the main sources of the high-G alginates in demand by these industries.

To fill growing demand, harvesting capacity of Laminaria hyperborea from Norway is expanding. Harvest numbers of Lessonia spp. from South America, along with reports of overexploitation, seem to suggest that this is a source that has plateaued. While harvest numbers quickly grew from 100 000 tonnes in 1999 to 330 000 tonnes in 2014, they have not grown further since, stalling to 315 000 tonnes in 2022 (Vásquez 2016; FAO 2024). At the same time, prices went from USD 350 in 2000 to USD 950 in 2009, peaking at USD 2 500 in 2023 before coming down again to USD 1 250 in 2024. The price surge suggests that demand is not being met. However, no high-G alginate is currently under commercial cultivation. Alginate from bacteria is an avenue that has so far not been seriously explored by science and industry.

With growing demand and constrained supply, we expect a continued price rise for high-G alginate-bearing species, which is likely to spur a more concerted effort to supplement wild harvests with cultivated alternatives.

Mixed-G alginates

A second source of predicted demand growth for alginates is biomaterials. Over the past decade, startups have developed biomaterials made in part from alginates for the commercial market. This includes textiles, foams, coatings and plastics. With varied approaches and material requirements, these applications are less in need of high-G alginates, and can instead tap into a variety of species with different M:G ratios. However, commercial roll-out has been hampered by a lack of demand for products that are seen as uncompetitive by the market in terms of cost and functionality compared to incumbent materials, despite their ecological credentials.

Projections of the segment’s evolution vary widely. Financial institutions predict the biomaterials market to grow enormously: the World Bank values seaweed-based textiles and bioplastics collectively at USD 1.6 billion by 2030, while Standard Chartered predicts the value of seaweed bioplastics alone to reach USD 1.8 billion by 2030 and an enormous USD 45 billion by 2050. On the other hand, consulting outfit DNV sees little significance for the biomaterials market in seaweeds.

At the time of writing, the total market for seaweed-derived biomaterials is estimated by stakeholders at no more than a few million USD in total. While it is possible that seaweed biomaterials manage to overcome challenges of cost competitiveness and functionality in the mid- to longterm, the evidence suggests that they will not reach the significant size predicted by financial institutes in the near-term.

New sources of low- to medium-G alginates under development include Sargassum spp. from harmful algal blooms in the Caribbean and cultivated Macrocystis pyrifera from Namibia, Alaska, New Zealand and Chile.

Food

In response to very high prices for Palmaria spp., cultivation efforts are increasing. In Canada, 50–100 tonnes are wild harvested annually while onshore cultivation already amounts to 350 tonnes per year. Onshore cultivation is also ramping up in Belgium, the Netherlands and the United States, while companies in Ireland and Denmark are piloting commercial cultivation of P. palmata at sea.

Saccharina spp. markets are in the curious situation of undersupply in Japan and possibly China, while in Europe and North America, farms have excess capacity and must dump unsold crops or keep them in storage. While companies’ efforts to increase consumption of Saccharina spp. in Europe and North America are likely to continue to grow the market, the demand side gap is considered to be very large and it is thus reasonable to assume it will take many years to fill.

The obvious answer here would be to sell Western Saccharina spp. to Eastern consumers, either directly or through joint-ventures, with Asian companies making use of European and American farm waters and automation technology, while their counterparts could avail of the strong product development and marketing skills in Asia. As an example, Canadian company Acadian Seaplants produces 700 tonnes of onshore cultivated Chondrus crispus annually for the Japanese salad market. The fact that this approach has not been pursued more often points to the challenges in building that bridge: different taste and sensory profiles of the species and a lack of size and sophistication among most Western producers are some of the barriers holding back possible rapprochement between markets.

Animal feed supplements for methane reduction

Between 2020 and 2023, the cultivation of Asparagopsis spp. as a feed supplement for livestock to reduce their methane emissions was funded by USD143 million of venture capital investments. These startup companies, which began operations between 2018 and 2022, have now reached pilot stage. Although producers of Asparagopsis spp. started cultivation at sea, almost all have now moved onshore to increase growth rates and production of the key ingredient bromoform. Only in Vietnam (and possibly Republic of Korea), trial production of Asparagopsis remains at sea.

While much science remains to be done, the fact that some companies have secured off-take agreements and are moving into the market shows that the sector is gaining traction. What is still unclear is to what extent Asparagopsis extracts can grab market share in the emerging livestock methane reduction market amid a wide range of competitors. Regulation, efficacy, cost and supply constraints will all play a role in determining the outcome.

Ecosystem services

Mirroring an evolution also seen in microalgae, macroalgae bioremediation of wastewater from aquaculture, households and desalination plants is an area garnering more interest from commercial actors, as some seaweeds can act as potent biofilters in a cost-effective way. Post-treatment, the seaweed biomass can be sold into different products to increase profits. Additionally, pollutant reduction credits can be obtained.

In 2017, influential environmentalist Tim Flannery started advocating for the large-scale cultivation of seaweeds to capture carbon dioxide. Since then, his ideas have come under scrutiny from phycologists and marine biologists. The verification, reporting and monitoring of possible carbon sequestered is considered to be very challenging, with many gaps in the science remaining, and a general consensus that the benefits of “blue carbon” were oversold (Williamson and Gattuso 2022; Boyd et al. 2024). Alongside, carbon credit markets saw a collapse in credibility in 2023.

With carbon markets discredited and the largest startup dedicated to sinking seaweeds folding in 2024, the narrative focus of the majority of startups, environmentalists and academics has shifted to mitigating carbon emissions through displacing or reducing carbon emissions of livestock, biomaterials or chemicals, or through the timely pick up and processing of harmful algal blooms (see for instance Ross et al. 2023; Canvin et al. 2024; Bullen et al. 2024). The lack of life cycle assessments (LCAs), and the wide variety of end results within existing LCAs are a key impediment to be able to state these arguments as fact. Those still looking towards credits aim for the new and not yet tainted biodiversity and nitrogen credit markets. While the idea of large-scale carbon capture through seaweed cultivation is no longer in vogue, Tim Flannery’s influence lasts, as his advocacy inspired startups either directly (Kelp Blue, Sea Forest) or indirectly (most other companies founded in 2018–2022).

Conclusion

Shift towards cultivation continues

Seaweed cultivation development is market-driven. If demand is low and natural resources adequate, cultivation is unnecessary. As demand increases, natural populations frequently become inadequate and attempts are made to increase production. Cultivation commenced in Asia, first for food markets, and later for aquafeed and hydrocolloid markets. Now market movements are pointing to the next phase with the cultivation of dulse, furcellaria, various species for bioremediation and Saccharina spp. and Macrocystis spp. for biostimulants and alginates.

Wild harvesting however still plays an important role in the supply of alginates, abalone feed, animal feed, biostimulants, food, cosmetics, lambda carrageenans and high-grade agar that is unlikely to disappear soon.

Biostimulant

importance grows The food market remains the most important market for seaweeds, both in terms of value and volume. However, biostimulants are the fastest growing segment within the seaweed sector and have already outflanked the agar, carrageenan and (perhaps) alginate markets. Projected to double in size by 2030, the biostimulant market will soon be second to food in terms of value for seaweeds globally.