Article II 2/2025 - TILAPIA: THE NEXT INDONESIAN SEAFOOD RISING STAR

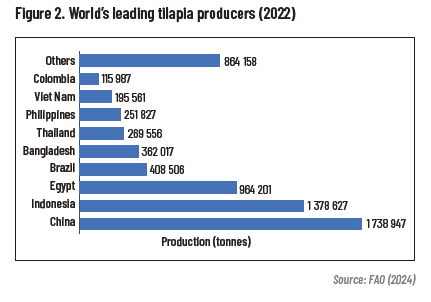

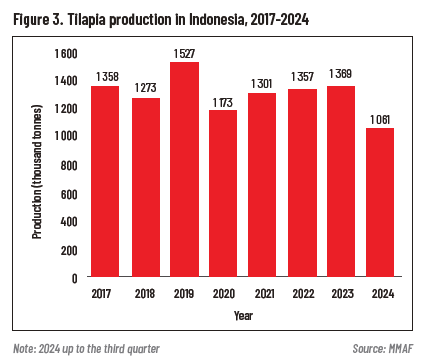

Indonesia is currently the second-largest producer of tilapia globally, with an annual production of 1.4 million tonnes. China leads the world with 1.7 million tonnes, but experts believe Indonesia’s production capacity is set to surpass that of China in the near future. In addition to its domestic production, Indonesia ranks fourth in the global tilapia export market, with a value of UD 82 million in 2023. Between 2017 and 2023, tilapia exports from Indonesia grew at an average rate of 7% annually, according to the Ministry of Marine Affairs and Fisheries (MMAF).

The Indonesian government has set an ambitious target to increase tilapia production to two million tonnes by 2029, aiming to meet both growing domestic demand and expanding export needs. As part of its food security plan, the government is working to boost fish consumption to over 62.5 kg per person by next year, and tilapia is expected to play a key role due to its affordability, availability, and ease of preparation. In terms of exports, Indonesia aims to capture 15% of the global tilapia market, which is projected to grow to approximately USD 13.05 million by 2030, reflecting an increase of about USD 2.7 million from its 2023 value, as reported by Research and Markets.

This article explores the history, national programs, targets, opportunities, and challenges within Indonesia’s tilapia farming industry and examines how the country can position itself as a global leader in tilapia production and export.

Development of tilapia farming in Indonesia

Current status of Indonesian tilapia production, processing, and marketing

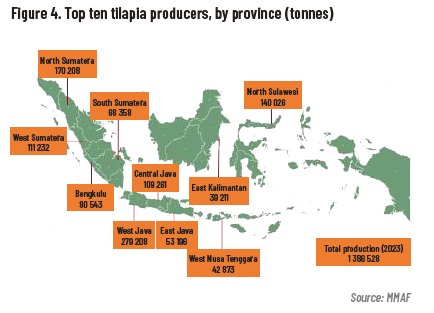

As a result of the introduction of new strains and the adoption of advanced farming technologies, including intensive and superintensive farming systems, the tilapia aquaculture industry in Indonesia experienced rapid growth. This led to a steady increase in production, which reached nearly 1.4 million tonnes in 2023 (compared to 225 tonnes in 1975), making Indonesia the second largest tilapia producer in the world (Figure 2). Tilapia production for 2017-2023 is shown in Figure 3, while Figure 4 shows the top 10 provinces, which account for nearly 80% of total production.

Of the 1 145 km² of Lake Toba, approximately 0.4 percent of the area is used for tilapia farming. In addition to two large farms, there are currently about 8 000 tilapia fish farmers in seven districts around Lake Toba. Tilapia farming in the waters of Lake Toba has had a positive impact on improving the economy of the communities around the Lake, especially the fish farmers. Local farmers are able to harvest an average of 10–20 tonnes of tilapia every 6–8 months from the 50 000 seeds they stock.

While traditional pond culture remains common, more advanced modern practices are gaining traction, including intensive pond culture, recirculating aquaculture systems (RAS), floating cages, and integrated multi-trophic aquaculture (IMTA). These modern practices are mostly used by large-scale farms that require higher capital investment and technologies that are more efficient and produce higher yields. Floating cages are mostly used for production in lakes and man-made dams.

Processing

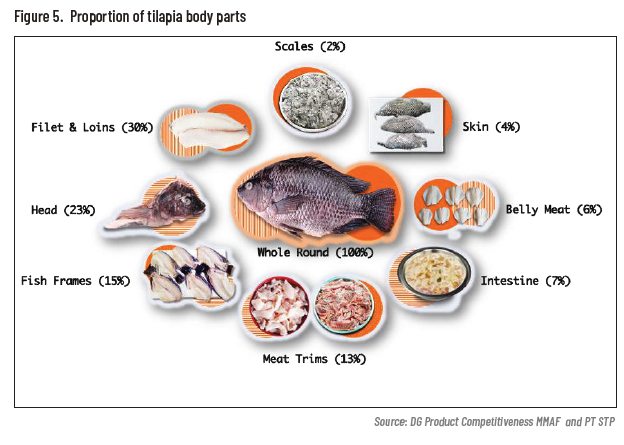

The processing of fillets generates a large amount of waste, which can be as high as 70%. This includes frames, belly, skin, head, trimmings and others in varying proportions (Figure 5). A zero-waste approach is common in modern processing plants in Indonesia, where these wastes are sold to users or converted into valuable products such as fishmeal and oil, fish jelly products, gelatine, collagen, mineral preparations and others, which have applications in the food, feed, pharmaceutical and cosmetic industries. The use of these wastes also benefits small businesses in the vicinity of the fillet processing plants that convert the edible wastes into food products. In addition, an integrated tilapia industry like the one in Lake Toba can create up to 4 000 jobs, while a smaller plant processing 15 tonnes of fillets per day is reported to create 50 direct and 150 indirect jobs.

Marketing

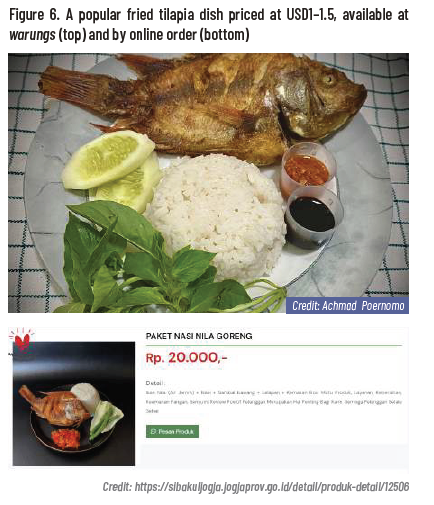

Tilapia is marketed both domestically and internationally, either fresh or processed. For domestic consumption, tilapia is mostly sold fresh or live through traditional and modern markets. Government campaigns promoting the nutritional value and benefits of eating tilapia have also attracted consumers. These campaigns highlight tilapia as contributing 95 calories per 100 grams and containing the following nutrients: 20 grams of protein, two grams of fat, 25 milligrams of magnesium, 170 milligrams of phosphorus, 300 milligrams of potassium, 40 micrograms of selenium, and 25 micrograms of folate. In addition, tilapia also contains omega-3 and omega-6 fatty acids, iron, zinc, choline, manganese, vitamin B12, vitamin D, and vitamin K.

With regard to global markets, Indonesian tilapia exports comprise 60% frozen fillets, 22% frozen whole, 14% chilled fillets, and 4% chilled whole. The tilapia is mainly exported to the United States (60%), Canada (21%) and the European Union (8%). Indonesia shares about 9.8% of the global export market, and ranks fourth after China (33%), Colombia (11%) and Honduras (10%).

Renewed focus on expansion

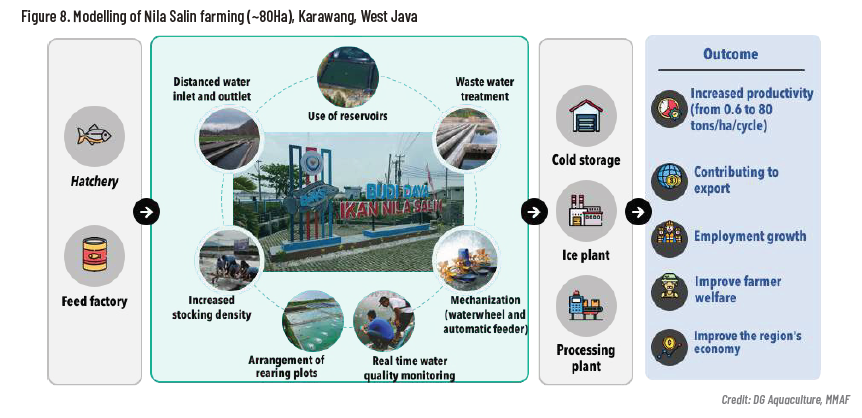

The second program focuses on modernising traditional pond farming practices. The development units of MMAF will act as a liaison with the traditional farmers to help disseminate the technology. This will ultimately help the farmers to improve production in terms of quantity, quality and safety aspects, as well as preserve the environment and thus sustain the business. Programs number 4 and 5 are designed to assist the farmers in marketing the fish at the local and global level.

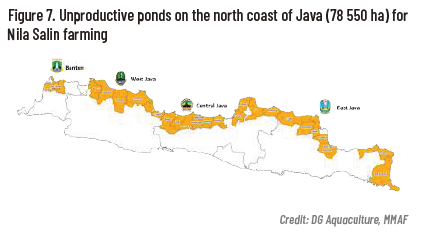

With the right investments in training, infrastructure, and sustainable farming practices, Nila Salin farming in Karawang is therefore poised to significantly increase Indonesia’s tilapia production, supporting both domestic consumption and export growth. Furthermore, it could serve as a model for other regions across Indonesia and beyond, paving the way for more resilient, sustainable, and profitable tilapia farming worldwide.

Strategic issues that need to be addressed

Disease management is a significant concern, as tilapia farms are vulnerable to outbreaks caused by vectors such as Tilapia Lake Virus (TiLV), which have impacted farms globally. Effective disease control, including strict biosecurity measures, disease surveillance, and vaccination programs, are essential to maintain healthy fish stocks.

The environmental impact of intensive farming, including water pollution, habitat loss, and ecosystem degradation, is another challenge. Climate change and unsustainable farming practices could exacerbate these issues by affecting water quality and the availability of fish feed. To mitigate this, sustainable practices such as improved waste management and recirculating aquaculture systems (RAS) are necessary.

Fish feed supply is another critical factor. The industry relies heavily on fishmeal and other ingredients; meanwhile, fluctuating prices and sustainability concerns are prompting interest in alternative feed sources like plant proteins, algae, and insect meal, to reduce dependency on traditional feed ingredients.

Global competition poses a challenge for Indonesian farmers. Countries like China, Vietnam, and Egypt, with their economies of scale and advanced production methods, create stiff competition. These countries can produce tilapia at a lower cost, making it difficult for Indonesian farmers to compete on price in international markets.

Quality control and standards are also issues. Many Indonesian farms are small-scale and lack access to advanced technology, leading to inconsistent fish quality and safety. Without adherence to international certifications like Global GAP and ASC, Indonesian tilapia struggles to access higher-value markets in the European Union and North America. Meeting global food safety and quality standards is crucial for market access.

Access to capital and financing is a major barrier for small and mediumsized tilapia farms. These farms often lack affordable financing for expansion, the adoption of new technology, or improving infrastructure. Without investment in innovative technologies such as RAS, automated feeding systems, and water treatment solutions, many farmers will struggle to compete with larger, more established producers.

Diffusing technology and building capacity continue to be challenging and need to be adequately addressed. These include limited resources, low awareness of advanced practices, poor infrastructure, and resistance to change. Inadequate training, weak extension services, minimal private sector involvement, and unclear policies also slow progress.

Lastly, regulatory and policy challenges pose additional obstacles. Inconsistent local and national regulations create complexity for farmers, while the slow pace of bureaucracy hinders reforms. Government support exists, but targeted interventions like subsidies for sustainable practices and investment incentives are necessary. To meet the growing global demand, particularly from Western markets with a focus on sustainability, Indonesia must improve environmental policies, a process which could involve significant costs.

Addressing these challenges is essential for Indonesia to realise the full potential of its tilapia farming sector and become more competitive in the global market.

Conclusion

Additionally, implementing effective marketing strategies – such as branding Indonesian tilapia as a premium product, expanding export markets, and leveraging digital platforms for global outreach – will be essential to increase market penetration. Addressing these issues will enhance the competitiveness of Indonesian tilapia while ensuring the industry’s resilience and sustainability amid rising global demand.